Monday Motivation: Secure Your Financial Future

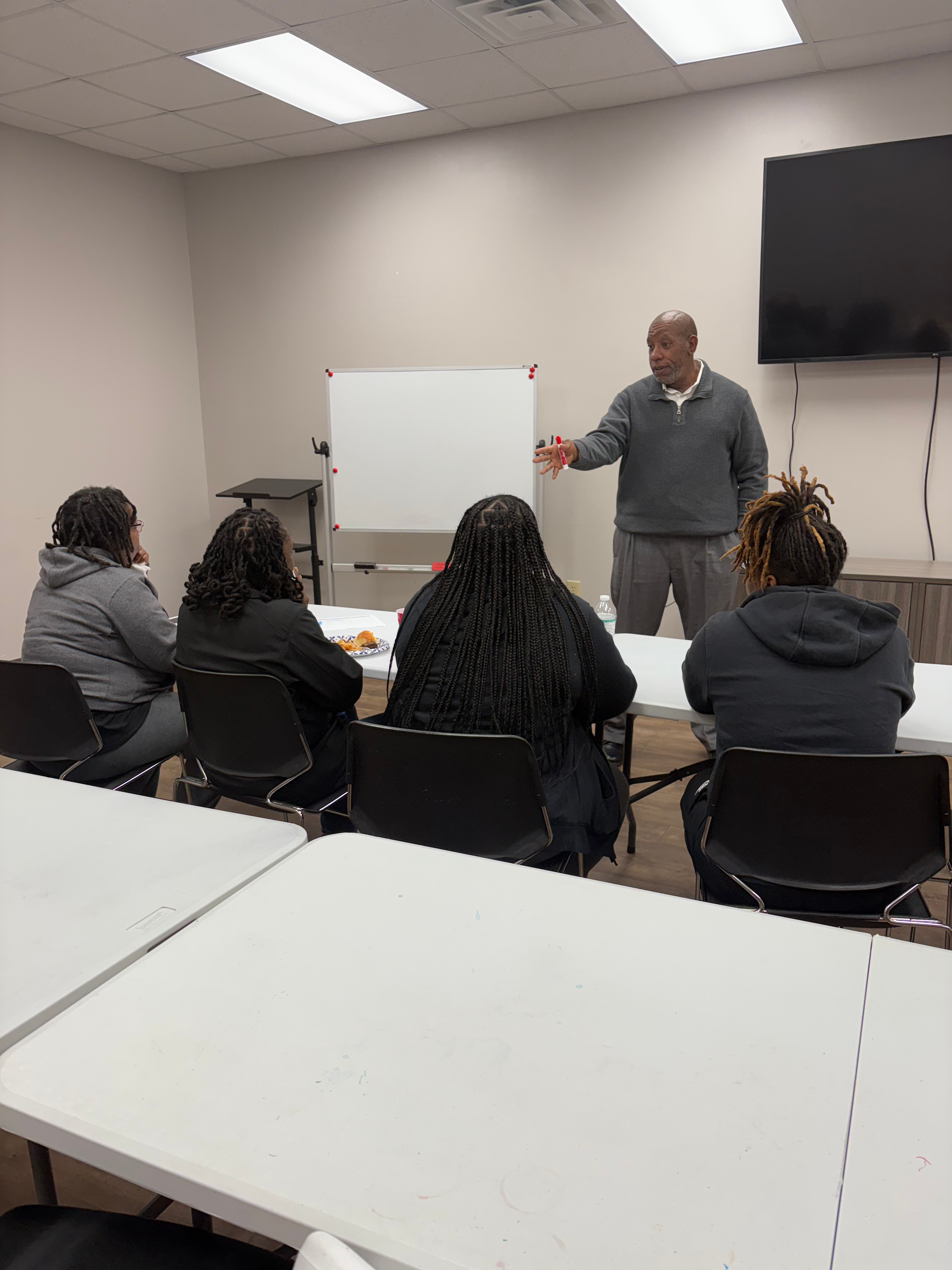

Securing Your Financial Future: A Call to Action for Young Men of Color

Securing Your Financial Future – A Call to Action for Young Men of Color

Financial literacy is more than just a skill—it’s a pathway to empowerment, independence, and generational wealth. For young men of color, understanding personal finance is critical to breaking systemic cycles of economic inequality and securing a brighter future. At JLD Community Solutions, we’re here to encourage and equip our community to take control of their financial journey. Let’s dive into actionable steps you can take today to protect your personal economic well-being.

Why Financial Literacy Matters

Research shows that financial literacy among Black youth is disproportionately low compared to other groups, leaving many unprepared for the financial challenges of adulthood. According to a study by Sue May (2023)[1], young Black men often lack foundational knowledge about savings, budgeting, and investing, even though they express eagerness to learn. This gap in education can perpetuate cycles of poverty and limit opportunities for wealth-building.

Did you know?

- 1 in 4 U.S. high school students is guaranteed to take a personal finance course before graduation in 2024, according to Next Gen Personal Finance (NGPF)[2][3]

- 10 states, including North Carolina, have fully implemented programs requiring economic and personal finance education[4][5]

Until Economic & Personal Finance courses reaches all of the classrooms in the U.S., it is vital that we teach our children early the importance of understanding money management and protecting our own personal economic. By taking proactive steps to improve financial literacy, young men of color can gain the tools needed to make informed decisions, build wealth, and take control of their personal finances.

3 Steps to Secure Your Financial Future

1. Start a Budget

A budget is the foundation of financial success. It helps you track your income and expenses, ensuring you spend less than you earn. Use this simple framework:

- Income: Calculate all sources of money coming in (e.g., wages, allowances).

- Expenses: Break these into fixed (rent, car payments) and flexible (groceries, entertainment).

- Savings: Allocate a portion of your income to savings first—this is called “paying yourself first.”

Using the 50/30/20 rule can be a great way to help build your budget:

- 50% for needs: Rent, utilities, groceries.

- 30% for wants: Entertainment, dining out.

- 20% for savings or debt repayment.

Resource: Download this Monthly Budget Worksheetfor Young Adults[6] to get started.

2. Build an Emergency Fund

An emergency fund acts as a financial safety net for unexpected expenses like car repairs or medical bills. Aim for $1,000 as your initial goal—it’s manageable even on a tight budget. Start small by saving $10–$20 per week and watch it grow. Once you've reached the goal of saving $1,000 then challenge yourself to save 3-6 months worth of expenses. #YouGotThis!

Tip: Open a high-yield savings account to earn interest while you save.

3. Educate Yourself on Wealth-Building

Wealth-building isn’t just for the wealthy—it’s for anyone willing to learn. Explore topics like:

- Investing: Learn about stocks, bonds, and retirement accounts like 401(k)s.

- Homeownership: Understand how owning property builds equity over time.

- Entrepreneurship: If you dream of owning a business, educate yourself on managing cash flow and business credit.

Resource: Check out Hands on Banking’s Budgeting Guide[7] for more tools and tips.

BONUS TIP: Protect Yourself Against Fraud & Scams

Monitor bank statements, set up alerts, and safeguard personal info to prevent identity theft.

Breaking Barriers Together

Systemic challenges like discrimination in financial systems have historically created obstacles for Black communities. However, by equipping ourselves with financial knowledge, we can challenge these barriers head-on. Remember: every small step you take today contributes to long-term stability and success.

Take Action Today

At JLD Community Solutions, we believe in empowering our community through education and action. Whether you’re starting with your first budget or saving your first $100 toward an emergency fund, every effort counts. Share this journey with your family—financial literacy grows stronger when it becomes part of our collective conversations.

Let’s work together to secure brighter futures for ourselves and the generations that follow. Are you ready to take control of your personal economics? Start today!

Resources:

- Monthly Budget Worksheet for Young Adults[6]

- Make a Budget Worksheet[7]

- Financial Literacy Tips for Black Youth[8]

Let’s build wealth together—one step at a time!

Citations:

- https://scholarlycommons.pacific.edu/uop_etds/3868/

- https://www.ngpf.org/state-of-fin-ed-report-2021-2022/

- https://www.ngpf.org/blog/press-releases/number-of-us-public-high-school-students-guaranteed-to-take-a-personal-finance-course-on-track-to-double-to-53-by-2030/

- https://d3f7q2msm2165u.cloudfront.net/aaa-content/user/files/Files/NGPFAnnualReport_2022.pdf

- https://d3f7q2msm2165u.cloudfront.net/aaa-content/user/files/Files/NGPF_AnnualReport_2023.pdf

- https://images.template.net/wp-content/uploads/2016/02/26071004/Monthly-Budget-Spreadsheet-for-Young-Adults-PDF-Free-Download.pdf

- https://consumer.gov/content/make-budget-worksheet

- https://www.metrodeep.com/blog/youth-financial-literacy

Other Citations:

- https://fndusa.org/wp-content/uploads/2015/06/SampleBudgetforTeens.pdf

- https://cliftoncorbin.com/financial-literacy-for-black-youth-why-it-matters/

- https://thestyledsoutherner.com/the-girls-guide-to-budgeting-free-template/

- https://nul.org/news/disparities-african-american-financial-literacy-serious-problems-concept

Disclaimer

Johnny Leroy Dawkins Jr Scholarship Fund dba JLD Community Solutions is not a licensed financial professional agency. This blog post is not sponsored; we’re simply sharing tips we hope you’ll find helpful! Please consult with your local financial institution or a licensed financial advisor for professional advice tailored to your situation.